One of the most common questions a futures broker gets is, “How do options on futures work?” The truth is, options can be as simple or complex as you want them to be. This article will focus on the basics of buying options on futures, basically starting from scratch.

There are two types of options, calls and puts. The options can either be bought or sold. We will only focus on buying options in this article. Buying a call gives you the right to take a long position on the underlying futures contract. Buying a put gives you the right to take a short position on the underlying futures contract. Simply stated, when you think the market will go up, buy a call. When you think the market will go down, buy a put.

Understanding the Strike Price

When purchasing a call or put, you will be doing so on an underlying futures contract (e.g. corn futues, gold futures, crude oil futures, etc.). The price at which you purchase the option is called the strike price. Options differ from futures in that you can purchase options at a variety of strike prices, whether the underlying market trades at the price or not. When purchasing the option, you can either purchase strikes that are out of the money, at the money, or in the money.

- Out of the Money Options – Out of the money call (put) options involve strike prices that are purchased above (below) where the underlying market is currently trading.

- At the Money Options – At the money call and put options are strike prices that are purchased where the underlying market is currently trading.

- In the Money Options – In the money call (put) options are strike prices that are purchased below (above) where the underlying market is currently trading.

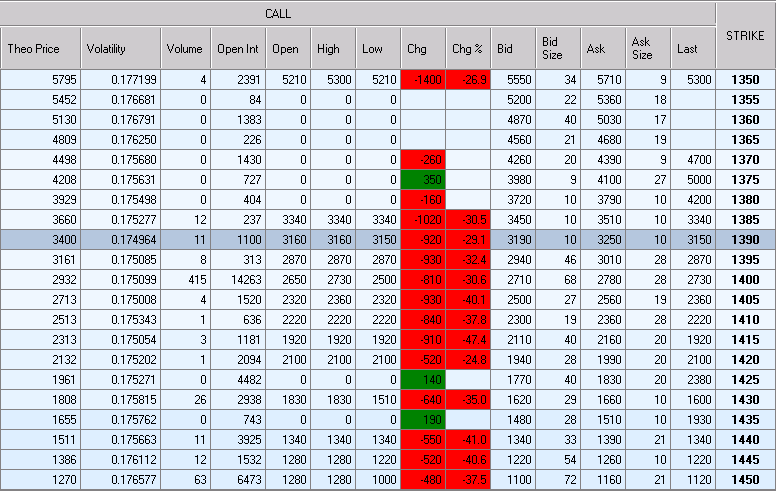

See the following screenshot for February Gold taken from the Vantage trading platform.

Any trades are educational examples only. They do not include commissions and fees.

This image is focused on calls. The darker blue line going across the 1390 option is currently at the money. The options from 1385 to 1350 are currently in the money, and the options from 1395 to 1450 are out of the money. There are three columns you want to focus on. They are the bid, ask, and last columns. The bid shows you what someone is looking to pay to purchase a call. The ask shows you how much money someone is willing to accept to sell the call, and last shows you what price the last trade took place. The more in the money the call (from 1385 to 1350), the more expensive it becomes. The further out of the money the call is (from 1395 to 1450), the cheaper it becomes.

Exercising a Purchased Option

Once a trader decides on a strike price and purchases a gold call, he will have the right to take a long position in the underlying gold futures market at the strike price purchased. If the trader chooses to use this right, he will have to exercise the option. Exercising the option is converting the call option to a long futures position at the strike price purchased. For example, the trader purchased a February 2011 1400 gold call with hopes that the market would continue in an upward trend. After a month of owning the option, the market is trading at 1435. The trader decides that he would like to exercise the option and be assigned a futures position at 1400. The trader will show a futures position with a profit of $3500 (100 (value per $1 gain in a gold futures contract) * (1435-1400)). However, the entire premium gained in the option is not transferred to the futures position. Why would the trader have exercised the position when it appears the position would have been more profitable as an option? There are two reasons: intrinsic value and time value.

Understanding Intrinsic Value and Time Value

An option is a wasting asset. Options, like futures contracts, have expirations. They tend to expire one month before the underlying futures contract. Intrinsic value and time value, make up an options premium or worth. Intrinsic value is the amount that would be credited to the traders account if the option was exercised and the subsequent long futures position is immediately sold at the market price. In our example above, the trader has a 1400 call with the underlying market trading at 1435. The intrinsic value of the option is $3500 (100 * (1435-1400)). An option will only have intrinsic value if it is in the money. Time value is what is left of the options premium. The further away an option is from its expiration, the more time value it will have. If the 1400 call has a premium of $5700, then the time value of the option is $2200 (5700-3500). The intrinsic value and time value must always add up to equal the options premium. As mentioned before, an option is a wasting asset. The closer the option gets to expiration, the more the time value will decrease. If the trader in the example above purchased the option on December 15th and exercised the position a month later, there would be very little time value still associated with the option. Since the trader knew that he would have an extra month for the futures contract to potentially increase, he chose to exercise the option.

Any trades are educational examples only. They do not include commissions and fees.

Offsetting an Option Position

A trader doesn’t always have to exercise an option. In fact, most don’t. Another way to get out of an option position is to offset the option. Offsetting an option simply involves selling the option that you purchased. For example, if you purchased a February 2011 1400 gold call, you can offset the call by simply selling it. If the option still has time value, this is the way that you can capture it and make it more profitable. In the example above, if the underlying gold price stays at 1435 and the trader holds the option to expiration, the option will be exercised and the trader will then hold a long futures position worth $3500. If the trader thinks the price of the underlying will stay the same, he can offset the position by selling the call he purchased for $5700, capturing the remaining time value.

Another Example in the Gold Market

Now that the basics of buying options on futures have been covered, let’s take a look at another example. A trader wants to get into a February 2011 gold option. He thinks that the market is going to continue on its current upward trend, so he wants to purchase a call. Keeping his account value in mind, the trader decides he is willing to spend $2500 on an option. After looking at the image above with strike prices, he decides to place an order to buy a February 2011 1405 gold call. He purchases the call option for $2500. Knowing that an option is a depreciating asset, he closely monitors gold prices while he is in the position. The trader is correct and the underlying gold contract increases to 1430 within two weeks. The trader now thinks that the underlying gold contract is going to remain at its current level or decrease until his option expires. The current value of his option is now $3700. The trader knows that the intrinsic value is $2500 ((1430-1405) * 100). He also knows that the time value on the option is $1200 (3700-2500). Since he thinks that the underlying price will remain the same or decrease, he decides to offset the position to capture the additional time value in the option. The trader ends up with a profit of $1200 (Premium of option when offset (3700) – premium when initially purchased (2500).

Options on futures don’t have to be the mountain that most make them out to be. Simply learn the basics and increase your knowledge as you progress in your trading. Before you know it, the mountain will become a molehill and you will have the knowledge to use options in your everyday futures trading.