Stop orders are primarily used to protect losses on a position, lock in profits on a position, or enter a market on a breakout. Regardless of the reason why a trader is using a stop order, buy stop orders are always to be placed at or above the market price (asking price), while sell stop orders are always to be placed at or below the market price (bid). If a trader places a buy stop order below the current asking price it will get rejected. If a trader places a sell stop order above the current bid price, it will get rejected.

The reason buy stop orders get rejected if placed below the current market price, and the reason sell stop orders get rejected if placed above the current market price, is because those are circumstances when a trader must use limit orders. Limit orders are used when executing trades at the market price or at a better price (at or lower than the market price for buy orders, at or higher than the market price for sell orders). Stop orders are used when executing trades at the market price or at a worse price (at or higher than the market price for buy orders, at or lower than the market price for sell orders).

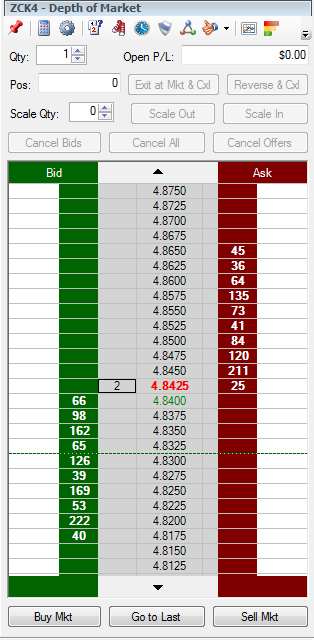

To illustrate this concept let’s look at an example of when a stop order would be accepted and when a stop order would be rejected using the Depth of Market below for May 14 Corn.

Example of an Accepted Stop Order:

Let’s imagine that a trader is looking to place a sell-stop order to protect a long position in May 14 Corn. If the bid and ask remain the same as shown below a trader must place his sell stop order at or below 4.8400 to ensure that the order is accepted. So an order to Sell 1 May 14 Corn on a Stop at 4.8300 would be accepted.

Any trades are educational examples only. They do not include commissions and fees.

Example of a Rejected Stop Order:

Let’s imagine that a trader is looking to enter a long position in May 14 Corn below the current asking price of 4.8425. In this case, the trader must use a limit order, since the trader is looking to enter the market at a better price than the market is offering. If the trader tried to place an order to Buy 1 May 14 Corn on a stop at 4.8300 the order would be rejected.