Best Futures Trading Strategies: 6 Ways to Minimize the Impact of Market Slippage

When it comes to the various hidden costs of futures trading, slippage is the undisputed king of the hill. When a market or stop-market order is...

Read More

Which Stop Loss Order Is Best for Your Strategy?

As any veteran trader will tell you, having your stops run is not a pleasant experience. However, it doesn’t need to be a financial disaster. While...

Read More

Are the Futures Markets Efficient?

According to the Efficient Market Hypothesis (EMH), the financial markets are methodical systems specializing in the valuation of assets. Under EMH,...

Read More

How to Choose the Best Futures Broker For Futures Trading

Choosing a futures broker is one of the most important decisions you will make for your commodity futures and options trading account. Whether you...

Read More

Types of Futures Trades: Basis, Spread, Hedging

One of the greatest advantages afforded to traders who actively engage the futures markets is the ability to satisfy a wide range of objectives or...

Read More

EIA vs. API Weekly Crude Oil Inventory

Just as it’s important for grain traders to watch a WASDE report, it is equally important for oil and gas traders to watch the release of an energy...

Read More

What Is the Difference Between Market Orders and Limit Orders?

Being able to enter and exit the market efficiently is vital to sustaining long-term profitability. To achieve this goal, active futures traders use...

Read More

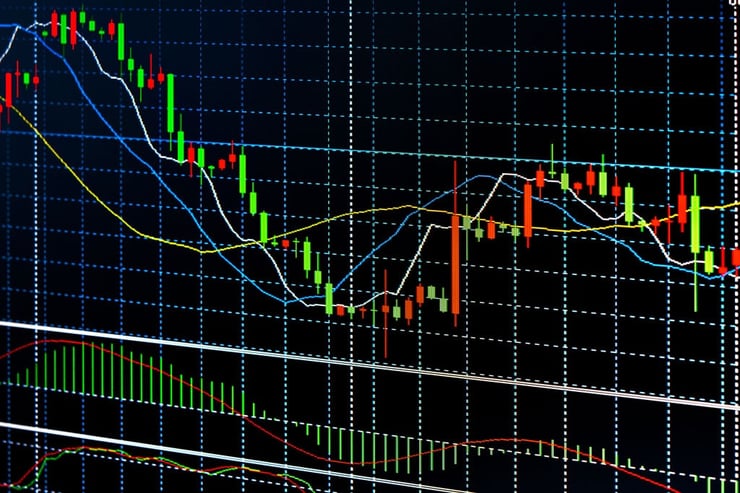

Top Tips for Trading Candlestick Patterns

Candlestick patterns are among the most frequently used technical tools by active futures traders. No matter the strategy―whether it is trend,...

Read More

How Does Implied Volatility Affect Options?

In the futures and options markets, volatility is a primary concern of every participant. No matter what you’re trading―whether it’s stocks or...

Read More